2013 Annual Report: Financial Report Fiscal Year 2013

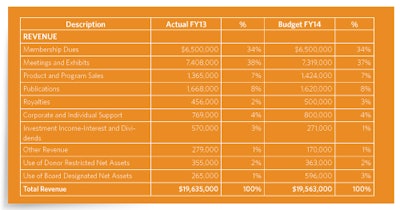

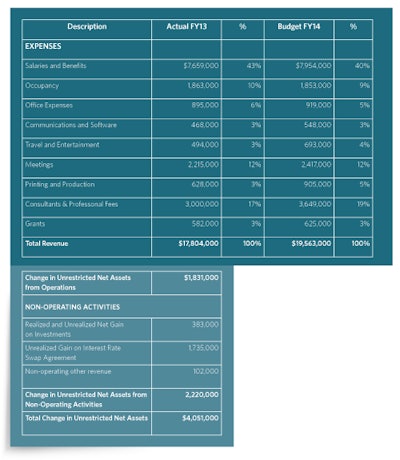

The fiscal year July 1, 2012, through June 30, 2013, (FY13) closed with a positive (unaudited) $1.8 million variance from the break-even budget. Overall, revenues were within 1 percent of budget and operating expenses were approximately 10 percent under budget. With respect to non-operating activities, the return on the managed investment portfolio was nearly 8 percent for the fiscal year. Additionally, a gain of $1.7 million was recorded to adjust for the change in market value of the interest rate swap agreement related to the financing of the headquarters building. In combination, operating and non-operating FY13 activity increased reserves by $4.1 million. As of June 30, 2013, unrestricted and undesignated reserves were $12.5 million or roughly 65 percent of the operating budget, a level considered within best practices. The Hal Foster, MD, Endowment, started only three short years ago, now has net assets, pledged, received or to be received in the form of life insurance proceeds or bequests, of $10.3 million as of June 30, 2013. These funds are permanently restricted as endowment principal, the earnings on which are used as directed by the donor at the time the endowment gift was made. Endowment earnings funded almost $60,000 of AAO-HNS/F FY13 programming. For a copy of the independent audit of AAO-HNS/F’s FY13 financial statements email CHanlon@entnet.org. In May 2013, the Boards of Directors approved a balanced fiscal year 2014 (FY14) budget. The budgeted revenue is approximately the same as FY13, $19.6 million, reflecting realistic expectations about opportunities for revenue growth. Budgeted expenses reflect inflation adjustments for continuing programs and support expenses. Without additional revenue to meet these increases, the Board carefully analyzed how to maximize member benefits with the available resources and made critical decisions about programs to be carried out in FY14. The budgeting process involved a concerted effort from the elected leadership at every critical decision point, and included several sessions with the Boards of Directors, Executive Committee, and the FISC. The positive results of FY13 reflect good fiscal management, but AAO-HNS/F leadership and staff will continue to watch rising costs against flat revenue growth as strategies for the organization are developed going forward. -Gavin Setzen, MD, Secretary/Treasure

The fiscal year July 1, 2012, through June 30, 2013, (FY13) closed with a positive (unaudited) $1.8 million variance from the break-even budget. Overall, revenues were within 1 percent of budget and operating expenses were approximately 10 percent under budget.

With respect to non-operating activities, the return on the managed investment portfolio was nearly 8 percent for the fiscal year. Additionally, a gain of $1.7 million was recorded to adjust for the change in market value of the interest rate swap agreement related to the financing of the headquarters building.

In combination, operating and non-operating FY13 activity increased reserves by $4.1 million. As of June 30, 2013, unrestricted and undesignated reserves were $12.5 million or roughly 65 percent of the operating budget, a level considered within best practices.

The Hal Foster, MD, Endowment, started only three short years ago, now has net assets, pledged, received or to be received in the form of life insurance proceeds or bequests, of $10.3 million as of June 30, 2013. These funds are permanently restricted as endowment principal, the earnings on which are used as directed by the donor at the time the endowment gift was made. Endowment earnings funded almost $60,000 of AAO-HNS/F FY13 programming.

For a copy of the independent audit of AAO-HNS/F’s FY13 financial statements email CHanlon@entnet.org.

In May 2013, the Boards of Directors approved a balanced fiscal year 2014 (FY14) budget. The budgeted revenue is approximately the same as FY13, $19.6 million, reflecting realistic expectations about opportunities for revenue growth. Budgeted expenses reflect inflation adjustments for continuing programs and support expenses. Without additional revenue to meet these increases, the Board carefully analyzed how to maximize member benefits with the available resources and made critical decisions about programs to be carried out in FY14. The budgeting process involved a concerted effort from the elected leadership at every critical decision point, and included several sessions with the Boards of Directors, Executive Committee, and the FISC. The positive results of FY13 reflect good fiscal management, but AAO-HNS/F leadership and staff will continue to watch rising costs against flat revenue growth as strategies for the organization are developed going forward.

-Gavin Setzen, MD, Secretary/Treasure