CMS 2013 Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center Payment Final Rule: What Academy Members Need to Know

CMS 2013 Outpatient Prospective Payment System (OPPS) and Ambulatory Surgical Center Payment Final Rule: What Academy Members Need to Know OPPS 2013 Final Payment Rates In the final rule, CMS finalized a hospital outpatient conversion factor rate increase of 1.8 percent, increasing the conversion factor from $70.170 in 2012 to $71.313 in 2013. This was due to an updated estimate of the market basket increase of 2.6 percent and an updated MFP adjustment of -0.7 percent minus the required .1 percent. CMS has also finalized the statutory -2 percent reduction in payments for hospitals that fail to meet the hospital outpatient quality reporting (OQR) requirements. Updates Affecting OPPS Payments For CY 2013, CMS has finalized the use of the geometric mean cost of services within an Ambulatory Payment Classification (APC) to determine relative payment weights for services. This is a drastic change from the former methodology, used since the inception of the OPPS in 2000, which relied on the median costs of services to establish relative weights for services. CMS states that this change is in response to commenters’ persistent concerns regarding the degree to which payment rates reflect the costs associated with providing a service, year-to-year variation, and whether packaged items are appropriately reflected in payment weights. CMS believes this new methodology will allow earlier detection of changes in the cost of services and may promote better stability in the payment system. In addition, it believes this will improve its ability to identify resource distinctions between previously homogeneous services. Changes to APC Classifications for CY 2013 In the final rule, CMS identifies services with a modified APC assignment for 2013 with a status indicator of “CH.” For 2013, CMS reassigned a number of ENT services to different APCs, resulting in fluctuations in payment for these services. For example, the sinus endoscopy with balloon dilation procedures (CPT 31295, 31296, and 31297) will remain in APC 0075, but will see a decrease in reimbursement for 2013 due to CMS’ decision to add several lower cost procedures to the APC. For changes in reimbursement rates for otolaryngology related APCs see the Academy’s full summary of the final rule. For a complete list of APCs and associated payment rates, access Addendum B to the final rule. CMS also made several changes to their list of exemptions from the two times rule outlined above. CMS makes exceptions in unusual cases, such as low-volume items and services. Two APCs included on the exception list for 2013 are relevant for the otolaryngology community: APC 0254 Level V ENT procedures and APC 0006 Level I Incision & Drainage. Lastly, CMS finalized its proposal to create a separate cost center for implantable devices. While this policy change appears to cause the payment rates for many procedures to decrease, physicians and hospitals should be aware that they will now be able to bill for two APCs (the procedure APC and the device APC), where applicable, and that overall payment may not be reduced. APC Assignments for New 2013 CPT Codes After the proposed rule was issued, the AMA CPT Editorial Panel created new CPT codes that became effective January 1, 2013. New CPT codes relevant to otolaryngology-head and neck surgeons include two new pediatric polysomnography codes (CPT 95782 and 95783) and several new allergy codes, including two ingestion challenge codes (95076 and 95079) and two percutaneous and intracutaneous allergy testing codes (95017 and 95018). OPPS Payment for Hospital Outpatient Visits Hospital Observation Status Policy In its comments to CMS on the proposed rule, the Academy recommended that CMS cap the amount of time a beneficiary can receive observation services as an outpatient to provide clarity on these requirements. The Academy also urged CMS to increase transparency of patient status for both patients and physicians and recommended that CMS automatically classify anyone who had received care in the facility setting for more than 48 hours as an inpatient. In response, CMS did not implement any immediate changes regarding these policies, but stated it will take all public comments into consideration as it considers future action. Hospital Outpatient Visit Policies For 2013, CMS will continue to recognize the three types of CPT and HCPCS codes describing clinic visits, Type A and Type B emergency department visits, and critical care services. A complete list of these codes can be found in Table 38 of the final rule. CMS will also continue to recognize existing CPT codes for critical care services; to set payment rate based on historical data; and to package the costs of care and ancillary services, despite AMA CPT Editorial Panel policy that requires hospitals to report ancillary services and associated charges separately. As a result, they will continue to use claims processing edits that package payment for ancillary services provided on the same date of service as critical care services. CMS states it will continue to monitor this policy for potential revisions in the future. Clarification of Supervision Requirements for Therapy Services in Hospitals and CAHs In response to concerns expressed in past years’ MPFS public comments, CMS clarifies that it does not intend to establish different supervision requirements for hospitals and critical access hospitals (CAHs) under §410.27 of the regulations for physical therapy, speech language pathology, and occupational therapy services provided in the outpatient setting when furnished under a certified therapy plan of care. CMS notes that if the services are billed by the hospital or CAH as therapy services, the supervision requirements do not apply. However, CMS notes that policies covered by §410.27,of the Medicare coverage manual, regarding supervision and other requirements do apply to PT, SLP, and OT services when those services are not furnished under a certified therapy plan of care (referred to as “sometimes therapy” services). Of note, the list of “sometimes therapy” codes includes negative wound pressure therapy codes and several debridement codes that may be used by otolaryngology-head and neck surgeons. Hospital Outpatient Quality Reporting (OQR) Program As established in previous rules, hospitals will continue to face a two percent reduction to their OPD fee schedule update for failure to report on quality measures in the OQR Program. Program measures can be accessed at www.QualityNet.org. CMS has confirmed it will continue the Electronic Reporting Pilot in 2013. Under this program, eligible hospitals and CAHs can continue to report clinical quality measure results by attestation under the Medicare EHR Incentive Program. CMS will also continue efforts toward alignment of several quality-reporting programs in an effort to relieve administrative burden. ASC 2013 Final Payment Rates In its final rule, CMS used the updated Consumer Price Index for All Urban Consumers (CPI-U) of 1.4 percent minus an updated MFP adjustment of 0.8 percent, and as a result will implement a 0.6 percent increase to the ASC conversion factor. These changes result in a CY 2013 conversion factor for ASCs of $42.917 compared to the 2012 CF of $42.627. Surgical Procedures Designated as Office Based Annually, CMS proposes to update payments for office-based procedures and device-intensive procedures using its previously established methodology. Office-based procedures are defined as surgical procedures that are used more than 50 percent of the time in the physicians’ offices. In the 2013 final rule, CMS has finalized, based on review of CY 2011 utilization data, permanent designation of six covered surgical procedures as “office based” within the ASC setting. Notably, three of those codes are Nasal/Sinus endoscopy procedures (CPT codes 31295, 31296, and 31297). This confirms that CMS will pay for these procedures at the lesser of the 2013 MPFS non-facility Practice Expense (PE) relative value unit (RVU) amount, or the proposed 2013 ASC payment amount. Payment for Device-Intensive Procedures in the ASC Setting CMS finalized adoption of the OPPS policy related to full benefit/full cost devices. This applies when the ASC receives the device without cost or with full (FB) or partial (FC) credit from the manufacturer. CMS also updated the ASC list of covered surgical procedures that are eligible for payment according to device-intensive procedure payment methodology, consistent with the proposed OPPS device dependent APC rules. CPT 69930, implantation of cochlear devices, is one of the services for which this policy will apply in CY 2013. The Agency has also published a list of specific devices for which the FB or FC modifier must be reported when the device is furnished at no cost (FB) or with full or partial credit (FC) that includes: L8614 (cochlear device/system); L8680, 85, 86, 87, 88 (Implant neurostimulators—five codes); and L8690 (Auditory osseo dev, int/ext comp). ASC Quality Reporting Program CMS finalized October 2012 as the date when ASCs were required to begin reporting claims-based measures that will be used to calculate 2014 payment. Payment penalties for ASCs who do not adequately report will remain at 2 percent. Quality measures can be found at: www.Qualitynet.org. For more information on the final rule, access the Academy’s full summary of finalized requirements at http://www.entnet.org/Practice/Summaries-of-Regulations-and-Comment-Letters.cfm#CL or email questions to Academy health policy staff at HealthPolicy@entnet.org.

OPPS 2013 Final Payment Rates

In the final rule, CMS finalized a hospital outpatient conversion factor rate increase of 1.8 percent, increasing the conversion factor from $70.170 in 2012 to $71.313 in 2013. This was due to an updated estimate of the market basket increase of 2.6 percent and an updated MFP adjustment of -0.7 percent minus the required .1 percent. CMS has also finalized the statutory -2 percent reduction in payments for hospitals that fail to meet the hospital outpatient quality reporting (OQR) requirements.

Updates Affecting OPPS Payments

For CY 2013, CMS has finalized the use of the geometric mean cost of services within an Ambulatory Payment Classification (APC) to determine relative payment weights for services. This is a drastic change from the former methodology, used since the inception of the OPPS in 2000, which relied on the median costs of services to establish relative weights for services. CMS states that this change is in response to commenters’ persistent concerns regarding the degree to which payment rates reflect the costs associated with providing a service, year-to-year variation, and whether packaged items are appropriately reflected in payment weights. CMS believes this new methodology will allow earlier detection of changes in the cost of services and may promote better stability in the payment system. In addition, it believes this will improve its ability to identify resource distinctions between previously homogeneous services.

Changes to APC Classifications for CY 2013

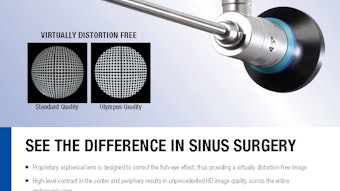

In the final rule, CMS identifies services with a modified APC assignment for 2013 with a status indicator of “CH.” For 2013, CMS reassigned a number of ENT services to different APCs, resulting in fluctuations in payment for these services. For example, the sinus endoscopy with balloon dilation procedures (CPT 31295, 31296, and 31297) will remain in APC 0075, but will see a decrease in reimbursement for 2013 due to CMS’ decision to add several lower cost procedures to the APC. For changes in reimbursement rates for otolaryngology related APCs see the Academy’s full summary of the final rule. For a complete list of APCs and associated payment rates, access Addendum B to the final rule.

CMS also made several changes to their list of exemptions from the two times rule outlined above. CMS makes exceptions in unusual cases, such as low-volume items and services. Two APCs included on the exception list for 2013 are relevant for the otolaryngology community: APC 0254 Level V ENT procedures and APC 0006 Level I Incision & Drainage.

Lastly, CMS finalized its proposal to create a separate cost center for implantable devices. While this policy change appears to cause the payment rates for many procedures to decrease, physicians and hospitals should be aware that they will now be able to bill for two APCs (the procedure APC and the device APC), where applicable, and that overall payment may not be reduced.

APC Assignments for New 2013 CPT Codes

After the proposed rule was issued, the AMA CPT Editorial Panel created new CPT codes that became effective January 1, 2013. New CPT codes relevant to otolaryngology-head and neck surgeons include two new pediatric polysomnography codes (CPT 95782 and 95783) and several new allergy codes, including two ingestion challenge codes (95076 and 95079) and two percutaneous and intracutaneous allergy testing codes (95017 and 95018).

OPPS Payment for Hospital Outpatient Visits

Hospital Observation Status Policy

In its comments to CMS on the proposed rule, the Academy recommended that CMS cap the amount of time a beneficiary can receive observation services as an outpatient to provide clarity on these requirements. The Academy also urged CMS to increase transparency of patient status for both patients and physicians and recommended that CMS automatically classify anyone who had received care in the facility setting for more than 48 hours as an inpatient. In response, CMS did not implement any immediate changes regarding these policies, but stated it will take all public comments into consideration as it considers future action.

Hospital Outpatient Visit Policies

For 2013, CMS will continue to recognize the three types of CPT and HCPCS codes describing clinic visits, Type A and Type B emergency department visits, and critical care services. A complete list of these codes can be found in Table 38 of the final rule. CMS will also continue to recognize existing CPT codes for critical care services; to set payment rate based on historical data; and to package the costs of care and ancillary services, despite AMA CPT Editorial Panel policy that requires hospitals to report ancillary services and associated charges separately. As a result, they will continue to use claims processing edits that package payment for ancillary services provided on the same date of service as critical care services. CMS states it will continue to monitor this policy for potential revisions in the future.

Clarification of Supervision Requirements for Therapy Services in Hospitals and CAHs

In response to concerns expressed in past years’ MPFS public comments, CMS clarifies that it does not intend to establish different supervision requirements for hospitals and critical access hospitals (CAHs) under §410.27 of the regulations for physical therapy, speech language pathology, and occupational therapy services provided in the outpatient setting when furnished under a certified therapy plan of care. CMS notes that if the services are billed by the hospital or CAH as therapy services, the supervision requirements do not apply. However, CMS notes that policies covered by §410.27,of the Medicare coverage manual, regarding supervision and other requirements do apply to PT, SLP, and OT services when those services are not furnished under a certified therapy plan of care (referred to as “sometimes therapy” services). Of note, the list of “sometimes therapy” codes includes negative wound pressure therapy codes and several debridement codes that may be used by otolaryngology-head and neck surgeons.

Hospital Outpatient Quality Reporting (OQR) Program

As established in previous rules, hospitals will continue to face a two percent reduction to their OPD fee schedule update for failure to report on quality measures in the OQR Program. Program measures can be accessed at www.QualityNet.org. CMS has confirmed it will continue the Electronic Reporting Pilot in 2013. Under this program, eligible hospitals and CAHs can continue to report clinical quality measure results by attestation under the Medicare EHR Incentive Program. CMS will also continue efforts toward alignment of several quality-reporting programs in an effort to relieve administrative burden.

ASC 2013 Final Payment Rates

In its final rule, CMS used the updated Consumer Price Index for All Urban Consumers (CPI-U) of 1.4 percent minus an updated MFP adjustment of 0.8 percent, and as a result will implement a 0.6 percent increase to the ASC conversion factor. These changes result in a CY 2013 conversion factor for ASCs of $42.917 compared to the 2012 CF of $42.627.

Surgical Procedures Designated as Office Based

Annually, CMS proposes to update payments for office-based procedures and device-intensive procedures using its previously established methodology. Office-based procedures are defined as surgical procedures that are used more than 50 percent of the time in the physicians’ offices. In the 2013 final rule, CMS has finalized, based on review of CY 2011 utilization data, permanent designation of six covered surgical procedures as “office based” within the ASC setting. Notably, three of those codes are Nasal/Sinus endoscopy procedures (CPT codes 31295, 31296, and 31297). This confirms that CMS will pay for these procedures at the lesser of the 2013 MPFS non-facility Practice Expense (PE) relative value unit (RVU) amount, or the proposed 2013 ASC payment amount.

Payment for Device-Intensive Procedures in the ASC Setting

CMS finalized adoption of the OPPS policy related to full benefit/full cost devices. This applies when the ASC receives the device without cost or with full (FB) or partial (FC) credit from the manufacturer. CMS also updated the ASC list of covered surgical procedures that are eligible for payment according to device-intensive procedure payment methodology, consistent with the proposed OPPS device dependent APC rules. CPT 69930, implantation of cochlear devices, is one of the services for which this policy will apply in CY 2013. The Agency has also published a list of specific devices for which the FB or FC modifier must be reported when the device is furnished at no cost (FB) or with full or partial credit (FC) that includes: L8614 (cochlear device/system); L8680, 85, 86, 87, 88 (Implant neurostimulators—five codes); and L8690 (Auditory osseo dev, int/ext comp).

ASC Quality Reporting Program

CMS finalized October 2012 as the date when ASCs were required to begin reporting claims-based measures that will be used to calculate 2014 payment. Payment penalties for ASCs who do not adequately report will remain at 2 percent. Quality measures can be found at: www.Qualitynet.org.

For more information on the final rule, access the Academy’s full summary of finalized requirements at http://www.entnet.org/Practice/Summaries-of-Regulations-and-Comment-Letters.cfm#CL or email questions to Academy health policy staff at HealthPolicy@entnet.org.