Financial Toxicity in Patients with Head and Neck Cancer

As clinicians and policymakers, it is our responsibility to address financial toxicity and support patients through their cancer journeys.

Danielle Scarola, MD, Liana Puscas, MD, Janice L. Farlow, MD, PhD, and Vikas Mehta, MD, MPH, on behalf of the Head and Neck Surgery Education Committee

Definition and Impact of Financial Toxicity

Financial toxicity (FT) refers to the economic burden and distress experienced by patients due to the high costs of cancer treatment. It can severely impact patients' quality of life and their oncologic outcomes.4,5 Tucker-Seeley and Yabroff categorize FT into three domains: material conditions (e.g., out-of-pocket expenses, debt), psychological response (e.g., anxiety, stress), and coping behaviors (e.g., medication non-adherence, avoiding healthcare).4

Financial stress can lead to decreased treatment compliance, poorer health outcomes, and even increased mortality. Patients experiencing high levels of financial stress may skip medications, miss appointments, or avoid necessary treatments altogether. Additionally, the stress associated with financial toxicity can exacerbate physical symptoms and contribute to increased inflammation, further compromising patients' health.4

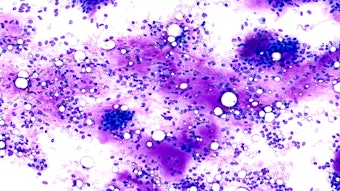

The financial impact on HNC patients is particularly acute. On average, medical expenses for HNC are higher than for other cancers owing to major surgical procedures, multimodality treatment (trimodal therapy was the most expensive), treatment-related complications (particularly for chemotherapy and radiation therapy), and longer hospital stays.6 In addition, patients with HNC often face additional burdens because of the nature of the disease, which can impair vital functions such as swallowing, speaking, and breathing, leading to prolonged and intensive treatment needs. This can be exacerbated by the inability to return to work in a large percentage of patients6 (>50% in some studies) since the loss of lifetime income has been shown to be the greatest contributor to the indirect cost of head and neck cancer. Furthermore, much of the United States population obtains health insurance through their workplace.6 Finally, the socio-demographic profile of HNC patients often includes lower income, public insurance reliance, and minority status, which compounds their financial vulnerability.3

Solutions to Address Financial Toxicity

Addressing FT requires comprehensive strategies to mitigate its impact on patients. The field of FT research is nascent, but early studies show that some interventions can have a significant impact on financial hardship, particularly if targeted toward high-risk individuals.7 Several approaches have shown promise:

Financial Navigators and Education

Implementing financial navigators in cancer care settings can help patients manage their expenses more effectively. These professionals assist patients in understanding their insurance benefits, applying for financial aid, and exploring payment options to reduce the economic burden.4

Screening Methods

Early identification of patients at risk for FT can facilitate timely interventions. Tools like the Comprehensive Score for Financial Toxicity (COST) and the Financial Index of Toxicity (FIT) instruments are designed to assess and quantify FT in patients, allowing healthcare providers to tailor support accordingly.4

Policy Interventions

Broader policy measures, such as capping out-of-pocket expenses, expanding insurance coverage, and increasing funding for patient assistance programs are crucial to alleviate the financial strain on cancer patients. Legislative efforts to control the rising costs of medications and treatments are also being investigated.

Psychosocial, Community, and Organizational Support

Non-profit organizations and community groups can play a vital role by providing direct financial assistance, resources for managing expenses, and emotional support to patients and their families. Social workers, community health workers, psychologists, and other professionals can also provide meaningful psychosocial support that affects the level of distress from FT.7

Conclusion

Financial toxicity is a critical issue for head and neck cancer patients, exacerbating the challenges they face from the disease itself. Rising treatment costs, compounded in some patients by existing socio-economic vulnerability, make it imperative to implement effective solutions to mitigate FT. By adopting comprehensive strategies, we can improve the quality of life and outcomes for HNC patients. As clinicians and policymakers, it is our responsibility to address this pressing issue and support patients through their cancer journeys.

References

- Abrams, H.R., Durbin, S., Huang C. Sx., Johnson, S. F., Nayak, R. K., Zahner G.J., Peppercorn, J. Financial Toxicity in Cancer Care: Origins, Impact, and Solutions. Translational Behavioral Medicine, Volume 11, Issue 11, November 2021, Pages 2043–2054, https://doi.org/10.1093/tbm/ibab091.

- Khan, H.M., Ramsey, S., and Shankaran, V. Financial Toxicity in Cancer Care: Implications for Clinical Care and Potential Practice Solutions. Journal of Clinical Oncology. 2023. 41(16). https://doi.org/10.1200/JCO.22.01799.

- Trosman, J.R., Koyfman, S.A., Ward, M.C., Rehmus, E., Gress, D.M., Adelstein, D.J., & Sweeney, P.J. (2019). Comparison of the Financial Burden of Survivors of Head and Neck Cancer With Other Cancer Survivors. Journal of Clinical Oncology. 37(22), 1885-1895. https://doi.org/10.1200/JCO.18.02133.

- Tucker-Seeley, R.D., & Yabroff, K.R. (2016). Financial Hardship and Patient-Reported Outcomes Among Cancer Survivors. Journal of the National Cancer Institute, 108(6), djw024. https://doi.org/10.1093/jnci/djw024.

- Ramsey, S.D., Bansal, A., Fedorenko, C.R., Blough, D.K., Overstreet, K.A., Shankaran, V., & Newcomb, P. (2016). Financial Insolvency as a Risk Factor for Early Mortality Among Patients With Cancer. Journal of Clinical Oncology, 34(9), 980-986. https://doi.org/10.1200/JCO.2015.64.6620.

- Rosi-Schumacher, M., Patel, S., Phan, C., & Goyal, N. (2023). Understanding Financial Toxicity in Patients with Head and Neck Cancer: A Systematic Review. Clinical Medicine Insights. Oncology, 17, 11795549221147730. https://doi.org/10.1177/11795549221147730.

- Rashidi A., Jung J., Kao R., Nguyen E.L., Le T., Ton B., Chen W., Ziogas A., Sadigh G. (2024). Interventions to Mitigate Cancer-Related Medical Financial Hardship: A Systematic Review and Meta-analysis. Cancer, Online ahead of print. https://doi.org/10.1002/cncr.35367.