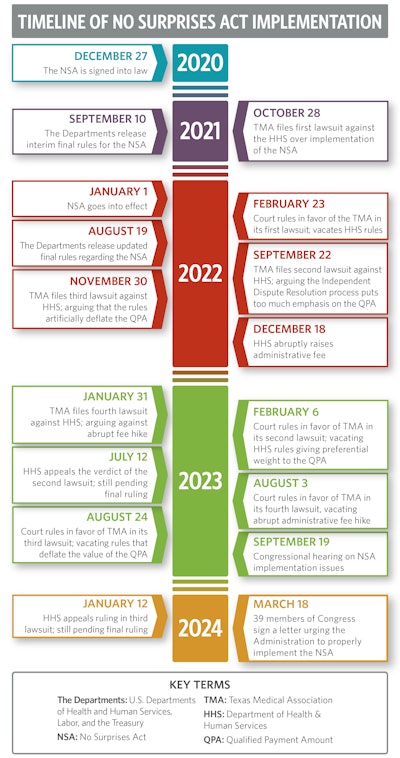

The No Surprises Act: A Timeline of Frustration

Negotiations have been complex and laden with disagreements since the No Surprises Act was signed into law in December 2020.

The history of the NSA can be traced back to years of bipartisan efforts to address the problem of surprise medical billing. Negotiations between stakeholders, prominently including the AAO-HNS and broader physician community, were often complex and laden with disagreements over how to resolve billing disputes and establish fair reimbursement rates for out-of-network services. Eventually, Congress reached a bipartisan solution.

Key Provisions of the No Surprises Act

1. Protection from Surprise Bills

The Act prohibits surprise billing in certain situations, such as emergency services provided by out-of-network providers or non-emergency services performed at in-network facilities where patients did not have the opportunity to choose an in-network provider.

2. Limiting Patient Responsibility

Patients are only responsible for paying their in-network cost-sharing amounts, such as copayments, coinsurance, and deductibles, even if they receive care from out-of-network providers in the situations outlined by the NSA.

3. Independent Dispute Resolution

The Act establishes a process for resolving disputes between healthcare providers and insurers over out-of-network charges. This process involves an independent arbiter who considers various factors, including the median in-network rate for the service in question, when determining the final payment amount.

A key aspect of this law is a fair and balanced independent dispute resolution (IDR) process, which has the potential to create challenging situations for physicians. Imagine that you have already chosen to remain out-of-network with a specific plan, likely because its contract rates were not appropriate—this law now forces you to the negotiating table with that same insurer. Congress knew this and was careful to include a broad range of factors that the arbiter must consider during these negotiations. Properly implemented, the NSA as conceived could work well for everyone. Unfortunately, this did not happen.

The Implementation of the No Surprises Act

Watch a short video where we break down the history of the NSA’s implementation detailed below or download a summary infographic at the end of this article.

Tipping the Scales Toward Insurers

On July 1, 2021, the U.S. Departments of Health and Human Services, Labor, and the Treasury (the Departments) released the Interim Final Rule (IFR): Requirements Related to Surprise Billing, Part I. This regulation defined many of the key terms in the NSA and how they would be applied. Immediately, there were concerns from the physician community. The primary issue involved the definition of the qualifying payment amount (QPA). In short, the QPA is intended to be the median in-network rate for a plan. However, this rule required the QPA to be calculated in such a way that it would usually end up being much lower than the median in-network rate.

On September 10, 2021, the Departments issued the IFR: Requirements Related to Surprise Billing, Part II. Again, the rules presented major concerns, specifically regarding the QPA. The NSA includes the QPA as one factor, among many, for the arbiter to consider in the IDR process. However, these final rules made the QPA the primary factor of consideration. In fact, the rules required arbiters to choose whichever offer was closest to the QPA. This tilted the entire process in favor of insurers. Essentially, physicians were forced to accept the median in-network rate as payment in full for out-of-network care—the same rate a physician refused to accept in the first place.

The physician community expressed strong concern that these rules were unacceptable and quickly took action. Two lawsuits were filed against the Departments of Health and Human Services (HHS). The Texas Medical Association (TMA) filed suit on October 28, 2021, and the American Medical Association (AMA) filed suit on December 9, 2021. The Academy joined amicus briefs in support of the lawsuits. The physician organizations in these suits argued that heavily weighing the QPA in the IDR process goes against both Congressional intent and the written language of the law.

While these suits were pending final rulings, the NSA went into effect on January 1, 2022, with the flawed rules in place.

Problems Begin Immediately

Almost immediately, the consequences of the law’s flawed implementation came to fruition. As predicted, many providers found themselves being kicked out of networks with plans that they had contracted with for many years. Insurers took this action because the implementation of the NSA essentially forced out-of-network providers to accept the median in-network rate, which insurers have ways to artificially deflate. In addition, HHS was woefully underresourced for the number of disputes it needed to handle. HHS received over 90,000 claims in the first few months—well over the amount they expected to receive over the whole year. A backlog quickly built up and providers waited months for their dispute to be reviewed.

On February 23, 2022, a federal court ruled that the NSA arbitration process implemented by HHS violated the Administrative Procedure Act, delivering a win to the TMA. The court agreed that the administration’s rules did not follow the language of the law and unfairly tipped the scales in favor of insurers. The AMA dismissed its own suit after this ruling, as this was the ruling they were ultimately seeking.

While this should have been the end of the problems, it was only the beginning. On August 19, 2022, the Departments released its updated final rules for the NSA. Although the rules were different, the key issue persisted; the Administration still gave preferential treatment to the QPA in the IDR process. The TMA filed suit again on September 22, 2022, arguing once again that the Administration was not following the law as written. The Academy also joined an amicus brief in support of this suit.

Meanwhile, the situation continued to deteriorate. It became clear that insurers had taken advantage of the rules and were doing everything they could to artificially deflate the QPA. This left many physicians between a rock and a hard place. They could either go in-network and accept a low rate or risk going through arbitration and be forced to take the low rate anyway in addition to paying a non-refundable administrative fee to enter arbitration. So, even if a physician won their claim, the financial gain may not be what they hoped.

On November 30, 2022, the TMA filed a third lawsuit against HHS. This suit argued that portions of the rule allow for artificial deflation of the QPA. The argument largely centered on the concept of “ghost rates.” Ghost rates occur when an insurer’s contract includes contract rates with providers who do not actually provide the service in question. The TMA said this unfairly lowers QPAs, “as there is little motivation for physicians or providers to negotiate rates for services they do not actually provide.” For example, a gastroenterologist is not concerned with how much an insurer will reimburse them for a septoplasty because they will never perform that procedure. However, the insurer could include an artificially low reimbursement for a septoplasty in their contract, therefore lowering the median in-network rate for all.

Soon after, on December 18, 2022, HHS abruptly announced that they would raise the administrative fee for arbitration from USD 50 to USD 350 (a 600% increase). This is the non-refundable fee both sides must pay to enter arbitration. This was problematic for two reasons. First, the change was announced without time to allow for public comments. Second, a USD 350 fee makes the process prohibitively expensive for many providers, particularly given that the amount many providers seek for each claim is often less than that. Thus, going through the IDR process became meaningless in many cases. The TMA filed a fourth lawsuit over this fee increase the following month.

The Courts and Congress Step Up

On February 6, 2023, the court ruled in favor of the TMA in its second lawsuit, deciding that the revised arbitration process “continues to place a thumb on the scale” in favor of insurers and that “the challenged portions of the final rule are unlawful and must be set aside.” HHS would once again need to go back to the drawing board and create rules that properly reflect the law, including a balanced IDR process.

HHS filed an appeal to this ruling on July 12, 2023. That appeal is still pending a final verdict. Meanwhile, HHS has had to issue guidance in the interim. As it stands, certified IDR entities can still consider the QPA and other relevant factors. Certified IDR entities may request, and disputing parties may provide, additional information relevant to the submitted QPA. However, there is no official rule about how an IDR entity should specifically use the QPA, as HHS waits for a ruling on its appeal. With this uncertainty, IDR payment determinations may be inconsistent, with different certified IDR entities applying different policies when considering QPAs.

In August 2023, the court handed losses to HHS in the third and fourth cases that the TMA brought against it. The courts found that the rules allowed the QPA to be inappropriately deflated and that the hiking of the administrative fee to USD 350 violated notice and comment requirements. HHS quickly lowered the fee back down to USD 50 but issued a proposed rule in October 2023 that brought the fee back up to USD 150 on January 1, 2024. HHS submitted an appeal to the ruling in the third case on the calculation of the QPA on January 12, 2024. That appeal is still pending a final ruling.

As HHS repeatedly lost in court, Congress began to take note of the situation. Physician organizations, including the Academy, made legislators aware of the fact that HHS was not following Congressional intent. The law was not being followed as written and physicians were facing the consequences. Backlogs continued to plague the system. Further, it was coming to light that many insurers were not paying out the claims they owed, even after losing disputes in the arbitration process.

On September 19, 2023, the House of Representatives Ways and Means Committee held a hearing on the flawed implementation of the No Surprises Act. Committee Chair Jason Smith (R-MO) noted that “Rulemaking has unfortunately ignored congressional intent.” Ranking Member Richard Neal (D-MA) concurred with this observation, declaring, “We will continue to work closely with the Administration to ensure that this law is implemented as Congress wrote it.”

During the hearing, the witnesses highlighted most of the key flaws with how the NSA had been rolled out. One of the most shocking testimonies came from a witness with Wellstar Health System, who told the committee that Wellstar was owed USD 40 million from insurers based on arbitration decisions. Wellstar had only received one-third of the payments they were owed. Another witness, an emergency medicine physician, also testified that his practice received multiple letters from insurers that they were reducing their contracted rates and if they did not accept them, they would be kicked out of network. Approximately 10% of his practice’s patients were pushed out of network. Overall, the hearing highlighted one key point: the Administration was not following the law as written and, as a result, was wreaking havoc on physicians and health systems across the country.

On March 18, 2024, 39 members of the House of Representatives signed a letter to the Secretaries of HHS, the Department of Labor, and the Department of the Treasury. The letter outlined their concerns and urged the Departments to properly implement the law. It states that many issues remain unresolved related to “The qualified payment amount (QPA), network shrinking, compliance, and enforcement with statutorily required payment timelines. Tracking and ultimately addressing such issues will be key to the long-term success of the NSA in resolving disputes and ensuring patient access to care.”

Where We Stand Today

While positive progress continues to be made in the courts and Congress, the situation is largely in a holding pattern. Two appeals from HHS are still awaiting a final verdict. The IDR process is currently open, and claims are being processed. However, because of legal uncertainty, guidance from HHS is vague and arbiters are essentially left up to their own discretion on how to use the QPA. Backlogs still persist but they are improving. Although Congress is acutely aware of the problems, it is holding back on further legislative action to address them. Legislators continue to agree that the law, as written, is a good one and can work. It is up to the Administration to implement it properly. Once rulings on the appeals are made, Congress may then explore legislative solutions.

The Academy is committed to voicing the concerns of our members with both the Administration and Congress. We will continue to monitor developments as they arise, keep our members abreast of important updates, and ensure that this law is implemented in a way that helps physicians and patients alike.