Medicare Payment Changes in 2026: What It Means for You

Five key takeaways to summarize what is changing and how these changes may affect your day-to-day practice.

Anna Hall, AAO-HNS Manager, Health Policy & Regulatory Affairs

Below are five key takeaways to summarize what is changing and how these changes may affect your day-to-day practice.

1. Medicare Conversion Factor Increase

For the first time in six years, CMS has finalized an increase to the Medicare conversion factor for CY 2026. Additionally, due to a law passed within the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), CMS will now use two separate conversion factors: one for qualifying providers (QPs) participating in Advanced Alternative Payment Models (APM), and one for all other providers. The CY 2026 conversion factors will be $33.5675 for QPs and $33.4009 for non-QPs.

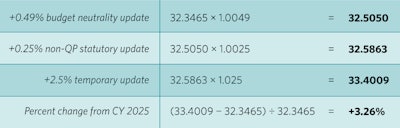

To calculate the updated conversion factors, CMS applied three distinct payment updates:

- A 0.49% increase to account for new policy changes outlined below

- A 0.75% and 0.25% increase for QPs and non-QPs, respectively

- A one-year, 2.5% increase required by the One Big Beautiful Bill Act (H.R. 1)

Instead of adding these adjustments together and applying them at once, CMS applied each increase sequentially, starting with the CY 2025 conversion factor (32.3465) and multiplying after each step. These calculations are depicted in the table below:

Most otolaryngologists fall into the non-QP category and will therefore see a 3.26% increase in Medicare payment next year. Although this increase is positive, its real-world impact depends on how other policies, including those outlined below, affect code-level payment. CMS’s own estimates suggest that, when all policies are combined, the overall impact on otolaryngology will be approximately 0% for 2026.

2. Decreases to Work RVUs—The “Efficiency Adjustment”

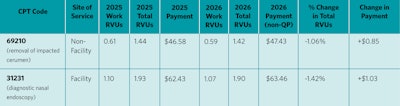

One of the most significant changes to Medicare physician payment for 2026 is a policy that CMS refers to as the “efficiency adjustment.” Asserting that physicians become more efficient at delivering care over time, and that payment should therefore reflect this presumed increase in productivity, CMS is applying a 2.5% reduction to work Relative Value Units (RVUs) for nearly all non-time-based codes. Codes exempt from this policy include Evaluation and Management (E/M) codes, new codes for CY 2026, and Medicare telehealth codes.

Since the efficiency adjustment is only applied to the work RVU portion of each code—not the total RVU—the impact of this adjustment on each code’s total RVUs will be less than 2.5%. As shown in the table below, the efficiency adjustment is expected to reduce total RVUs by approximately 0.5%–1.5% for most otolaryngology services. However, because CMS increased the 2026 non-QP Medicare conversion factor by 3.26%, most ENTs will experience a net positive payment update, despite the reduction in RVUs.

CMS intends to revisit the efficiency adjustment approximately every three years—meaning future reductions are possible without congressional intervention. The Academy, along with many other specialties, strongly opposes this policy, as it lacks supporting evidence and results in broad, automatic devaluation of physician work.

3. Changes to Practice Expense (PE) Methodology

CMS also finalized a major update to how indirect practice expenses are allocated for services performed in hospital (facility) settings. Historically, CMS has allocated the same amount of indirect PE, which includes administrative labor, technology, utilities, etc., per work RVU for services performed in both the facility and non-facility settings. However, as physicians shift their employment from the practice to the hospital setting, CMS believes that most of these overhead costs will be incurred by the facility as opposed to the physician directly. To reflect this assumption, beginning in 2026, CMS is reducing the portion of indirect PE RVUs tied to work RVUs by 50%. This policy reflects CMS’s belief that hospitals and health systems now bear more administrative and overhead responsibilities than in the past.

For otolaryngologist-head and neck surgeons, CMS estimates a –12% impact on total allowed charges in facility settings. In contrast, non-facility settings (e.g., office-based practices) can anticipate a +3% impact. Real-world impacts will vary significantly based on practice structure, patient volume, site of service mix, and subspecialty focus.

4. Payment for Tympanostomy Tubes and Related Services

For tympanostomy services, CMS finalized payment for code 0583T (tympanostomy using an automated tube delivery system with iontophoresis local anesthesia). After reviewing recommendations from the American Medical Association/Specialty Society Relative Value Scale Update Committee (AMA RUC), CMS cross walked CPT code 0583T to CPT code 31295 (nasal/sinus endoscopy, surgical, with dilation) for physician work, time, and direct practice expense inputs, determining that the resource use and intensity were comparable. As a result, CPT code 0583T will receive an assigned national payment rate beginning in CY 2026. CMS also maintained contractor pricing for G0561 and acknowledged the RUC’s plan to review CPT codes 0583T, 69433, and G0561 in the future.

Other ENT-relevant code families, including fine needle aspiration and nasal sinus irrigation, were not designated as potentially misvalued, which avoids further payment uncertainty for 2026.

5. What to Expect from the Quality Payment Program (QPP)

Although the 2026 final rule does not introduce sweeping QPP changes for otolaryngology, several updates may still affect your reporting and potential payment adjustments. For example,

- To provide continuity and stability to program Merit-based Incentive Program (MIPS) participants, CMS has opted to maintain the current performance threshold at 75 points through the CY 2028 performance year (2030 MIPS payment year).

- For MIPS Value Pathways (MVPs), CMS will allow groups to self-attest to their specialty composition (single vs. multispecialty) during MVP registration.

- CMS reinstated AAO16: Age-Related Hearing Loss: Audiometric Evaluation and removed Screening for Social Drivers of Health to the ENT MVP.

Importantly, in the final rule, CMS reiterated its intent to sunset traditional MIPS and fully transition to MVPs by the CY 2029 performance period (2031 MIPS Payment Year). At that time, MVPs would become mandatory for most otolaryngologist-head and neck surgeons. The Academy will continue to engage with CMS and will provide timely updates to members throughout this transition. As always, Reg-ent℠ participants can contact the Reg-ent team at regent@entnet.org for additional information, assistance, or questions.

Final Thoughts

The CY 2026 Medicare Physician Fee Schedule reflects CMS’s continued effort to balance statutory requirements, evolving care delivery models, and budget pressures. Although physicians can expect an overall increase in Medicare payment, other finalized policies, such as the efficiency adjustment and changes to practice expense methodology, will create meaningful financial implications for ENT practices across settings.

The Academy continues to advocate strongly on behalf of otolaryngologist–head and neck surgeons and will provide additional resources and analysis to help members navigate these changes. For questions about how these policies may impact your practice, contact the Academy’s Health Policy Advocacy team at healthpolicy@entnet.org.